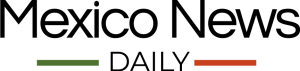

Foreign direct investment (FDI) in Mexico amounted to US $18.6 billion in the first quarter of the year, according to preliminary data reported by the Economy Ministry (SE) on Sunday.

The figure is 4.1% less than the amount reported during the first quarter of 2022, when FDI reached US $19.4 billion.

However, the FDI seen during the first few months of last year was extraordinarily high due to the Televisa-Univisión merger and the restructuring of Aeroméxico, which resulted in a combined value of more than US $6 billion. If these two transactions are excluded, the FDI reported in the first quarter of last year would be only US $12.6 billion, or 48% lower than the first three months of 2023.

“The behavior observed in the first quarter of 2023 represents the confidence of investors to maintain and expand their investments in the country,” the SE said in its report.

The FDI seen in the first quarter of 2023 alone amounts to half of what was received in 2022, when investment reached its highest levels since 2015. The favorable first quarter is likely attributable to companies nearshoring to Mexico, according to Bloomberg Línea.

Foreign investment during the first three months of the year came from 1,387 Mexican companies with foreign capital participation and 863 trust agreements. About 90% of the total investment, or US $16 billion, was reinvestment of profits, while 5% corresponded to new investments and another 5% to loans and payments within the same corporate group.

Most, or 67%, of all FDI was concentrated in only five states, with Mexico City capturing the highest amount, at 38% of all foreign investments, equivalent to US $7 billion. This was followed by Nuevo León, with US $2.3 billion, or 13% of the total; and Jalisco, with US $1.1 billion, or 6% of the total. Puebla and México state also ranked among the top earning states, with US $920 million and US $892 million, respectively.

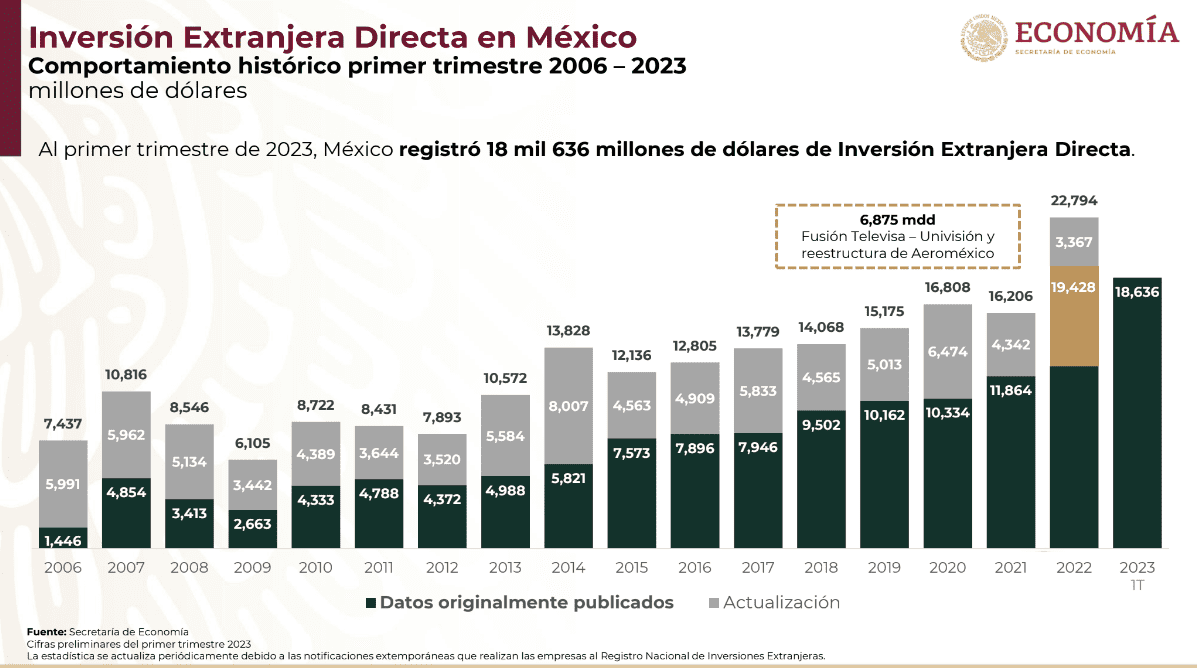

The United States was Mexico’s largest trading partner by a significant margin between January and April, contributing US $6.4 billion. Spain invested the second highest amount, with US $3.7 billion. Argentina, the Netherlands, Germany, Canada, the United Kingdom, Switzerland, Japan and Brazil rounded out the top 10.

Just over half of all investments corresponded to the country’s manufacturing sector. When broken into subsectors, FDI in transportation equipment, the chemicals industry, computer equipment, electric power generation equipment, metals, and the beverage and tobacco industries saw the highest levels.

Another 33% was related to financial services; 4% to transport, mail and storage; and 2% each to mining, construction, retail and wholesale trade.

With reports from Aristegui and Bloomberg Línea